Maryland Tax Filing Deadlines for 2021 | Ryan & Wetmore - Accountants, CPAs, & Consultants

Extended Deadlines for Certain Maryland Tax Filings and Payments in 2021

The state of emergency related to COVID-19 proclaimed by Governor Lawrence J. Hogan, Jr. on March 5, 2020 continues. Due to the economic impact on individuals and businesses, the Comptroller has extended due dates for certain Maryland tax filing types.

The controller has extended the time to file for the following items with statutory due dates between January 1, 2021 and April 14, 2021 to April 15, 2021 including:

- Corporate and pass-through entity (partnerships and s corporation) income tax returns and income tax payments

- Individual and fiduciary estimated income tax declarations

This means taxpayers have until April 15th to make Maryland 4th quarter income tax payments usually due on January 15th.

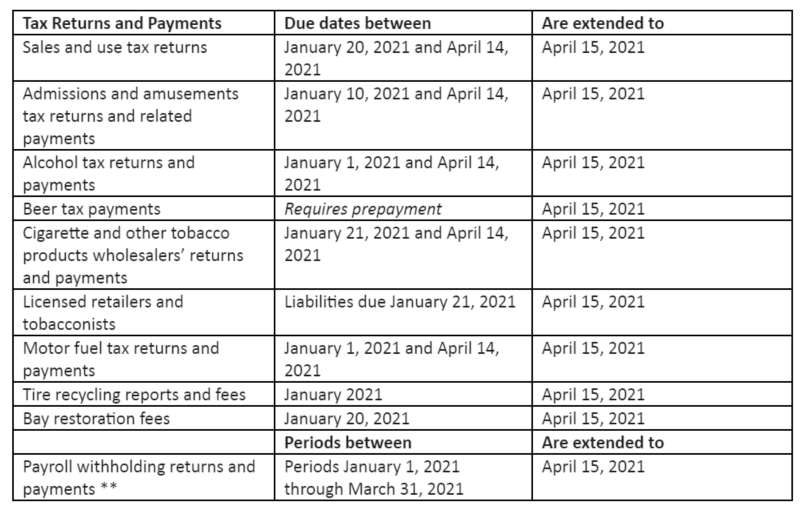

The comptroller has also extended time to file and pay taxes on other business taxes (see PDF for full details):

**Please note, payroll withholding returns and payments for all periods through December 31, 2020, including the 2020 year end reconciliation due in January are due on their statutory due dates.

Today’s Thought Leaders

Contact us today by calling 301-585-0506.

About Chloe Parker

Senior Manager, CPA, & MBA

Chloe Parker is a Manager in our Bethesda, MD office. Since joining the firm in 2011, Chloe has worked closely with entrepreneurial clients on tax, audit, and accounting issues. Chloe works across industries including government contracting, construction, manufacturing, and professional services industries.

About Mike Wetmore

Partner & CPA

Michael co-founded Ryan & Wetmore PC in 1988 and works closely with clients to identify the best strategies for their specific situation. Over the years, he has developed expertise serving the following practice areas: estates and trusts, High net-worth individuals, and healthcare organizations.

About Traci Getz

Partner & CPA

Traci is a partner with Ryan & Wetmore, PC and is based in our Frederick, MD office. The Frederick office is home to the firm’s small business services department. Traci currently works with clients on individual, corporate, and tax compliance issues along with a variety of accounting and consulting services for small and medium-sized business owners.

About Jason Dudas

Director & CPA

Jason is a Senior Manager in our Vienna, VA office. Since joining the firm in 2009, he has worked closely with clients on tax, audit and accounting issues. Jason has become an expert in construction accounting and is a member of the Real Estate and Construction CPA’s. He also has experience with research and development credits, and tangible property regulations.