Navigating Financial Risks in Healthcare: Strategies for Mitigation

Key Details: Amidst the financial complexities and risks facing the healthcare sector, from inflation and outdated contracts to workforce shortages and diminishing market share, healthcare organizations are navigating a challenging landscape. Effective mitigation strategies include service line assessments, workforce prioritization, leveraging patient feedback, outsourcing non-clinical tasks, and seeking strategic collaborations. These measures are vital for enhancing financial health, staff morale, and organizational resilience in the dynamic healthcare industry. A focus on balancing financial strategies with supportive workforce practices is essential for sustained success. In response to these challenges, healthcare organizations are urged to adopt comprehensive and strategic approaches to fiscal management and operational efficiency. If your healthcare organization is seeking to navigate these complex issues, Ryan & Wetmore is here to assist. Contact Ryan & Wetmore today to learn how we can help your organization achieve financial stability and growth in the ever-evolving healthcare landscape.

Financial Challenges in Healthcare:

Facing considerable financial risks, the healthcare industry is navigating a complex landscape. Preceding the challenges brought on by the COVID-19 pandemic, many organizations were already wrestling with financial pressures. The current scenario presents healthcare entities with a confluence of issues, including inflation, outdated vendor and payer contracts, and reductions in reimbursement rates. Complicating matters further is the expiration of COVID relief funding, limiting avenues for direct government assistance.

In general, various indicators of financial risk are prevalent across all industries, healthcare included. Some of these signs include:

Workforce scarcity: The shortage of accessible talent spanning industries and experience levels poses a challenge to organizations in their capacity to produce goods, deliverables, or provide services.

Decreasing reimbursement rates: Healthcare payers persist in lowering reimbursement rates across numerous services, with a proposed cut exceeding 3% for physicians in 2024.

Limited access to capital: Faced with escalating debt, constrained liquidity, full utilization of credit facilities, and diminishing margins, healthcare organizations find themselves with diminished capital resources.

Diminished referrals: Patients are now gravitating towards flexible coverage alternatives instead of depending solely on employer-sponsored healthcare plans. Contributing factors include insufficient patient engagement, ineffective retention strategies, physician retirements, or a lack of expertise among individual physicians.

Diminishing market share: With the market witnessing an influx of new competitors and the expenses associated with acquiring new customers on the rise, numerous organizations are experiencing a decline in their market share.

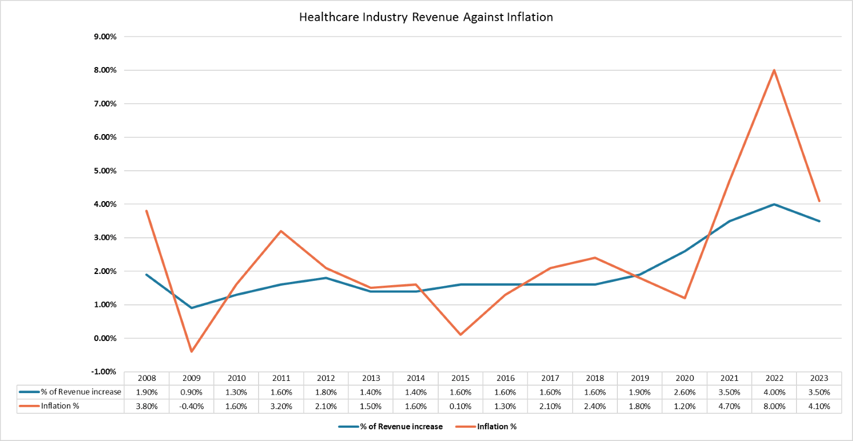

Inflation belittling revenue increases: The graph below outlines the revenue increases (light blue line) in the healthcare industry over the past 15 years, and the inflation rate (orange line) over the past 16 years. Revenue saw a great increase in 2022, however, in reality revenue needed to be four percentage points higher to break even with inflation for 2022.

Source: https://www.usinflationcalculator.com/inflation/current-inflation-rates/

Strategies for Mitigation

Whether your emphasis is on tackling financial challenges, ensuring stability, or fostering growth, the following measures can assist your organization in attaining improved financial well-being:

Conduct a thorough service line assessment

Discontinuing a service line can be a challenging and time-consuming process. It is crucial for organizations, irrespective of their size, type, or financial standing, to prioritize and regularly carry out evaluations of their service lines. At the same time, healthcare provider organizations should retain service lines that hold utmost significance for their communities, even if discontinuing them could enhance financial stability.

Prioritize your workforce

It is essential to concentrate on providing support to both clinical and back-office staff to prevent labor shortages and retain valuable talent. Organizational leadership should have a deep understanding of and involvement in all operational aspects, including walking through the halls during various shifts. Regular surveys of staff members regarding their employee experience are crucial, ensuring their connection to the organization's vision and values. Incorporating enhancements based on employee feedback, such as on-site childcare and behavioral health services, should be integral to discussions.

Gain insight into your patients' preferences and needs

Leaders should regularly seek out patient reviews to identify areas for improvement. Develop a strategic plan based on this feedback to implement changes that not only meet patient needs but also prioritize investments in technology and modernization. This includes embracing services such as telehealth, facilitating access to patient portals, enabling online check-in, and incorporating other emerging capabilities.

Delegate non-clinical responsibilities

Entrusting tasks like IT, revenue cycle optimization and management, call centers, and supply chain management to external sources can promptly enhance financial well-being.

Explore collaboration possibilities

Healthcare entities, regardless of their size or structure, have the potential to seek partners whose vision, values, and strategy resonate with theirs. Whether forming a partnership with an investor or another institution, like a hospital system teaming up with a physician group or serving as the on-site medical services provider for a lifestyle/longevity center, engaging in mutually advantageous agreements can contribute to financial stability.

Reviewing payors for profitability

Reviewing payors in the healthcare industry for profitability involves analyzing reimbursement rates, administrative burden, patient population, contractual terms, and growth potential. By assessing these factors, providers can prioritize partnerships with payors that offer the greatest profitability and sustainability.

Consider offering services at higher profit margins

Offering medical services at higher profit margins in the healthcare industry requires strategic specialization, operational efficiency, innovative technologies, favorable reimbursement negotiations, and exceptional patient experiences. These elements combine to drive profitability through premium services, streamlined operations, and enhanced value proposition.

Conclusion

Leaders in healthcare organizations should recognize that while addressing financial challenges is paramount, maintaining the confidence of clinical staff is equally critical. The interplay between financial stability and staff morale is pivotal, as a loss of confidence in leadership can adversely affect organizational culture, job satisfaction, and employee well-being, potentially leading to increased staff turnover. Balancing financial strategies with a focus on cultivating a supportive and confident workforce is essential for sustained success in the ever-evolving landscape of the healthcare industry.

Today’s Thought Leaders

About Peter Ryan

Partner, Co-founder, & CPA

Peter T. Ryan co-founded Ryan & Wetmore in 1988 with business partner Michael J. Wetmore. Peter provides clients with the best strategies for success. His expertise extends across various industries. Peter obtained a Master of Business Administration in Finance from the University of Baltimore and a Bachelor of Arts in Accounting from the Catholic University of America.

About Billy Carr

Staff Accountant

Billy Carr serves as a Staff Accountant at Ryan & Wetmore, specializing primarily in Auditing & Assurance (A&A) and tax engagements. He works with a diverse range of clients across various industries, applying his tax knowledge to meet their specific needs. A proud alumnus of Furman University, Billy earned his degree in Accounting, laying the foundation for his professional career in the field.