M&A in the Wake of the 2020 Election -

2020 Election Could Impact Middle-Market M&A: Predictions & More

Companies across a range of industry sectors and geographies are experiencing a surge in M&A activity and dealmaking. As the election quickly approaches and mail-in ballots continue to be cast, now is a good time for dealmakers within the middle-market to consider what impacts the 2020 election could have on M&A activity. It is no question that the election will influence the M&A landscape, but how it will change M&A activity is the real conundrum.

While there is no way of being entirely certain of what the true outcome of the election will be, in conjunction with its effects, there are some things we can predict knowing what we already know about M&A and its relation to politics.

Below is a collection of our predictions that we may see unfold if the Democrats are to secure both the Senate, the Houses of Representatives, and the White House.

An M&A Market if Democrats Control the White House & Congress

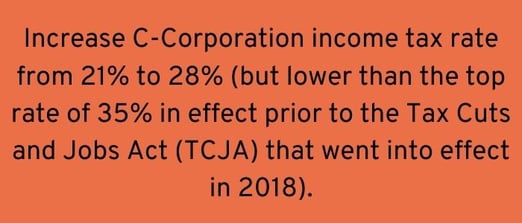

Tax policy continues to make an impact on M&A activity, and Donald Trump’s and Joe Biden’s plans are starkly different. We could see significant changes in the M&A market if Biden were to win the election and the Democrats were to occupy Congress. If the current proposed tax plan of Joe Biden is enacted, it would include the following policy changes:

Business Tax Changes

Significance

Biden’s proposed tax changes as they relate to businesses would greatly impact C-corporations. As a result of this increase, businesses will have to pay more in income taxes, decreasing cash flow. In turn, this will impact businesses on both the buy and sell-side. Companies on the sell-side risk being valued for less due to cash flow concerns, and since sell-side companies will have unfavorable valuations they would be less likely to sell. However, companies on the buy side see these as buying opportunities that could pay off in the long-run. Given these varying considerations, tax policy will cause a major disruption in M&A activity, including a rush to make deals before tax law changes.

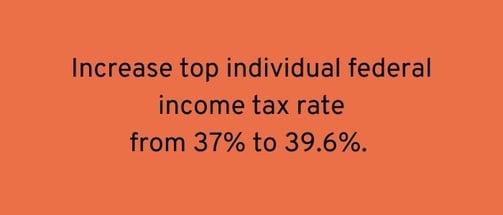

Individual & Payroll Tax Changes

Significance

Something to note is that this increase from 37% to 39.6% would not reduce long-run growth. Reason being that the short-term nature of the tax reduction under the Tax Cuts and Jobs Act (TCJA) is not set to expire until 2026. In a similar manner, we can also anticipate the same effect, should Biden win the election, with regard to individuals earning over $400,000. While Section 199A is expected to expire in 2026 under TCJA, Biden’s tax plan includes the elimination of the 20% QBI deduction. Companies with numerous high earners should consider the reality where cash flow is notably impacted.

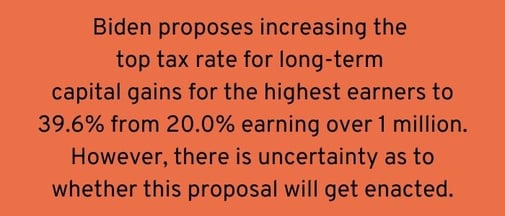

Significance

For owners of pass-through entities, the proposal to increase the capital gains rate to 39.6% on income over $1 million will be a major factor in considering whether or when to sell their business. In the M&A space, the sale of a business is taxed at a capital gains rate. And with this proposed increase, which would be the largest increases in capital gains rate history, dealmakers and business owners may be discouraged to sell. However, the businesses that are not entirely deterred from selling can possibly benefit from greater tax savings now if a sale agreement is closed by the end of this year. Installment sales made in the year 2020 will have their taxes reflect the tax policy of this year, but will then have the remaining installments reflect Biden’s tax policy (if the election is in his favor) in the latter years.

In contrast to businesses that are reluctant to sell/buy, researchers and economists have found that an increase in capital gains taxes has led to the selling of stocks. An impending tax increase might ignite activity as owners seek a tax-efficient business exit.

Either decision, to sell or not to sell, and to buy or not to buy, will come with its own pros and cons.

*** These changes in Biden’s proposed tax policy will likely only become law if both the Senate and House of Representatives have a Democratic majority and they agree to the bill ***

Influence of COVID-19 on M&A Deals

While mergers & acquisitions were just short of a complete standstill in March of 2020, the M&A outlook is robust. The potential upcoming change in tax legislation, coupled with the turbulent and ambiguous economic environment due to the coronavirus crisis, are changing the manner in which M&A deals are developed and negotiated. Overall, sellers are claiming that 2020 operations are not indicative of the business’s history, while buyers, in contraposition, are concerned businesses will not return to normalcy in the coming future. Both sellers and buyers are adjusting to the dynamic circumstances to mitigate their business risks with changes to dealmaking and deal terms including:

- Deeper due diligence will be performed.

- Strategic earnouts provisions will be negotiated in deals.

- More complex escrow, holdbacks, working capital, and other price adjustment provisions will be proposed.

- Installment sale transactions will see gains taxed at different rates in 2020 and 2021.

- Modifications to pre-closing business covenants, representations and warranties, and material adverse provisions will be proposed;

- Alternative forms of considerations and changes to terms of debt financing.

Final Remarks

There is much on the line as the November 3rd election date inches closer, but if one thing is certain, it is that middle-market companies need to:

- Be proactive and develop a comprehensive M&A plan that is reflective of either a Biden or Trump tax policy. If contemplating a sale, start planning TODAY;

- Know how COVID-19 will affect their particular industry and how market conditions may influence them;

- Organizes a team of advisors;

- Compute your net proceeds from a business sale after taxes to ensure you are receiving the net proceeds from the sale that you desire.

Despite the outcome, M&A will find a way to continue marching on.

For more assistance on any of the topics mentioned above, please do not hesitate to contact our team of M&A Specialists.

Source: Tax Foundation

Today’s Thought Leaders

About Tessa Lucero-Bennett

Senior Manager, CPA, & MBA

Tessa is a Senior Manager at Ryan and Wetmore. Tessa has over 20 years of experience serving and advising businesses in all phases of the organizational life cycle. Her experiences range from traditional accounting and tax services to complex consulting services, including business planning, financial budgets and projections, benchmarking and financial trends, M&A support and analytics, internal controls assessment, development of best business practices, and financial training for top management levels.

About Pete Ryan

Co-founder & Partner

Peter T. Ryan co-founded Ryan & Wetmore in 1988 with business partner Michael J. Wetmore. Peter provides clients with the best strategies for success. His expertise extends across various industries, including M&A. Peter obtained a Master of Business Administration in Finance from the University of Baltimore and a Bachelor of Arts in Accounting from the Catholic University of America.