Preparing for an IPO During a Market Slowdown (Part 1 of 2)

Introduction

The IPO market today is quiet, a steep fall off from 2021’s record year. While many companies filed S-1s in 2021 and 2022 and remain waiting in the wings, others have put IPO plans on pause. In Part 1 of this two-part series, we explore the lessons learned from the 2021 IPO rush, the steps you can take to prepare, as well as the downsides associated with a delay. Stay tuned for Part 2 where we discuss other potential challenges you may face as you prepare for an IPO during a market slowdown.

Interested in growing your business? Contact us today to learn more about how we can take your business to the next level.

Lessons Learned

Among the lessons learned from the 2021 IPO rush has been the importance and extent of the preparation needed for private companies to seamlessly hit the ground running on Day 1 as publicly traded companies. Tell-tale signs of inadequate preparation were apparent in many cases through the 2021 IPO rush, with symptoms in the form of missed financial reporting deadlines, restated financial statements, newly uncovered material weaknesses in internal control over financial reporting, unanticipated costs and missed earnings forecasts, recognizable inability to execute on promised growth strategies, and ultimately investor loss of confidence and disappointing stock price performance in the secondary market. Some missed their opportunity altogether because they weren’t ready while market conditions were favorable.

As private equity firms are weighing exit options and liquidity paths for their portfolio companies, the current market slowdown can be used as an opportunity to conduct an IPO Readiness assessment and execute on the necessary steps to get ready and stay ready for when the IPO opportunity is right or pursue a dual track for alternative deal opportunities.

The Time to Prepare is Now

Performing an IPO readiness assessment enables organizations to establish a baseline of a company’s current state and prioritize its development and transformation needs to become IPO-ready, which could take as long as 18 to 24 months to execute. Effective change management during this transformation period is key, which can be enabled through diligent project management. Building the right teams and processes and putting in place the right technology are defining elements to establishing a company’s infrastructure to support its growth strategies, including the opportunities opened by being a public company. But trying to build this critical foundation after becoming a newly public company, while trying to keep up with the pace of regulatory reporting requirements, investor scrutiny, and general precision and speed of reaction expected of a public company, can easily become overwhelming to an organization. Also, many private equity firms look to recruit leadership with experience running a public company, who can help transition the organizational culture, norms, and processes to those of a public company. Finding and building an effective team is often a time-consuming process.

There’s No Such Thing as a Perfect IPO Window

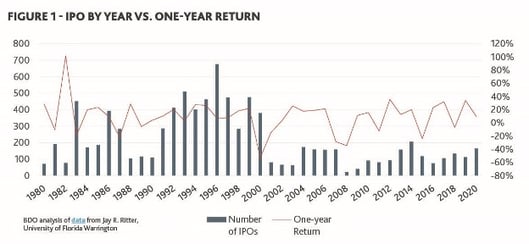

The ideal IPO window is different for every company and industry. Although the timing of an IPO can impact valuation, long-term IPO performance is not correlated, as demonstrated in Figure 1.

All of this is to say: the best time for an organization to IPO is subjective, dictated by what investors believe about the long-term performance of the company, as reflected in company valuations.

The Downsides of Delay

With a rushed IPO, mistakes along the way will likely damage market confidence. Similarly, if a company drags out the readiness process, it could miss the opportunity to attain the best possible valuation. Starting the process sooner rather than later allows for speed when it is necessary without sacrificing quality.

Conclusion and Next Steps

Among the key elements of a successful IPO is taking the time to prepare and being ready for life as a public company. A market downturn is an excellent opportunity to perform a readiness assessment and build the muscle to operate like a public company. By preparing now, private equity firms can ensure their portfolio companies are ready to IPO when the market turns around and create the conditions for a successful exit.

Businesses considering an IPO are encouraged to take the following steps to stay ahead of any future challenges:

- Begin by assessing your readiness, review your internal financial statements and future budgets and forecasts.

- Ensure teams are effectively managed and updated technology is in place.

- Review the regulatory and reporting requirements public companies are subject to and conduct an internal review of current compliance.

- Determine your filer status.

- Begin crafting your registration statement.

Stay tuned for Part 2 of this series and contact Ryan & Wetmore for more information.

Today’s Thought Leaders

About Peter Ryan

Partner, Co-founder, & CPA

Peter T. Ryan co-founded Ryan & Wetmore in 1988 with business partner Michael J. Wetmore. Peter provides clients with the best strategies for success. His expertise extends across various industries. Peter obtained a Master of Business Administration in Finance from the University of Baltimore and a Bachelor of Arts in Accounting from the Catholic University of America.

About Rosie Cheng

Finance Consultant

Rosie Cheng is a Finance Consultant at Ryan & Wetmore. She focuses on government contracting services and produces many of the firm’s government contracting newsletters. Rosie graduated from Georgetown University with a Master of Science in Management and from William and Mary with a Bachelor of Business Administration.