Interested in the CHIPS Act? Stay Tuned for Future Funding Opportunities

Key Details: On August 9, 2022, the “Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022” (CHIPS Act) was signed into law. The CHIPS Act aims to combat severe supply chain disruptions by promoting U.S. manufacturing competitiveness, innovation, and security. The Act focuses on domestic production while seeking further R&D and commercialization solutions of cutting-edge technology. As such, the CHIPS Act of 2022 provides the appropriations needed to implement authorized programs from the bipartisan CHIPS for America Act. It is important to note that the Act allocates funds to projects outside of semiconductor manufacturing such as supporting the adoption of emerging telecommunications technologies and wireless software-based technology. As such, businesses outside of semiconductor manufacturing are also encouraged to review the Act to determine potential program eligibility.

The CHIPS Act of 2022 also provides the required appropriations for the USA Telecom Act. This program aims to fund projects to capitalize on U.S. software advantages. This includes the development of an open-architecture model (OpenRAN) to allow alternative vendors to enter the market for specific network components. As the CHIPS Act provides funding for a wide variety of projects, businesses are encouraged to fully review the various projects and funding requirements to consider how to participate.

Government Funding

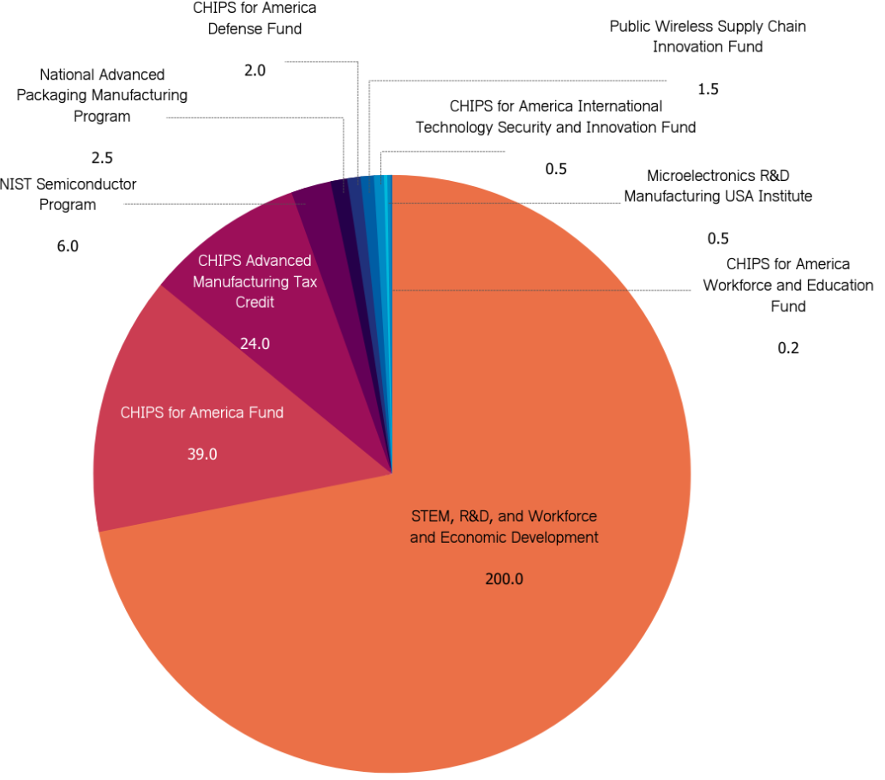

The graphic below shows the allocation of funds to various categories under the Act:

Eligible recipients will aid in the production or manufacturing of semiconductor materials and equipment. As such, competition for government funding will be conducted through applications to the Department of Commerce (DOC). Businesses are encouraged to review the funding documents that will provide specific application guidance when they are expected to be released in February 2023. Furthermore, the DOC has noted that preference will be given to manufacturers who secure state or local incentives. Projects that proactively work to ensure small or disadvantaged businesses benefit from the CHIPS Act will also be prioritized. As such, businesses are encouraged to thoroughly review state or local projects and to determine where partnerships with small businesses may be beneficial to both parties.

Funding Activity Specifics

The following are funding categories under the CHIPS Act, businesses are encouraged to review program activities to determine where there may be a potential opportunity to compete for funding.

CHIPS for America Fund:

The CHIPS for America Fund receives $39 billion in funding to build, expand, or modernize domestic facilities and equipment relating to semiconductor fabrication, assembly, testing, advanced packaging, or R&D under the DOC Manufacturing Incentives program. This includes $2 billion allocated to mature semiconductors and up to $6 billion allocated to the cost of direct loans and loan guarantees.

The CHIPS for America Fund also allocates $11 billion for DOC R&D relating to:

- Advanced semiconductor manufacturing R&D and prototyping. This includes investment in new technology and expanding workforce training.

- Strengthening advanced assembly, test, and packaging (ATP) capabilities.

- Partnerships between the government, industry, and academia to research virtualization of semiconductor machinery. This includes the development of ATP capabilities and training.

- A National Institute of Standards and Technology (NIST) research program to advance measurement science, standards, and other related capabilities.

CHIPS for America Workforce and Education Fund:

This program receives $200 million to start the development of the domestic semiconductor workforce.

CHIPS for America Defense Fund:

$2 billion is allocated for the Department of Defense (DoD) to implement the Microelectronics Commons. This is a national network of onshore, university-based prototyping of semiconductor technology.

CHIPS for America International Technology Security and Innovation Fund:

The Department of State (DOS) receives $500 million to support international information and communications technology security and semiconductor supply chain activities. This includes supporting the development and adoption of telecommunications and other emerging technologies.

Public Wireless Supply Chain Innovation Fund:

$1.5 billion will be used to spur movement towards “open-architecture” and software-based wireless technologies. Funding will be made towards innovative technologies in the U.S. mobile broadband market.

What is the Tax Credit Offered?

The Advanced Manufacturing Investment Credit from the CHIPS Act adds to Section 48D of the Internal Revenue Code. This tax credit offers eligible manufacturers a 25% credit for constructing semiconductor manufacturing facilities. This also includes facilities that produce manufacturing equipment required for the manufacturing of semiconductors. As such, tangible property essential to the facility qualify. Construction of these manufacturing facilities must begin by January 1, 2027, to qualify. Manufacturers aiming to benefit from the tax credit must avoid relations with “foreign countries of concern.”

Though there is no expected guidance provided specifically by the CHIPS Act, recipients of funding and tax credit will need to comply with various federal requirements. This includes, but is not limited to, the following items:

- Davis-Bacon prevailing wage requirements.

- Prohibition of the use of funds on stock buybacks.

- Prohibition of the use of funds for dividend payments to shareholders.

- Reporting requirements as required by the funding agency or other Congressional reporting requirements relating to workplace data.

Conclusion

The CHIPS Act provides a huge opportunity for businesses to compete for funding. Businesses are encouraged to conduct an internal analysis of current operations and projects to determine the capacity to take on new projects. Forming new alliances and partnerships throughout the supply chain may also allow businesses to reap further benefits. It is important to note for businesses that there is also an allocation of funds for projects outside of semiconductor manufacturing such as communications and software-based wireless technologies. As such, interested businesses are encouraged to review each program for potential eligibility.

Today’s Thought Leaders

About Peter Ryan

Partner, Co-founder, & CPA

Peter T. Ryan co-founded Ryan & Wetmore in 1988 with business partner Michael J. Wetmore. Peter provides clients with the best strategies for success. His expertise extends across various industries. Peter obtained a Master of Business Administration in Finance from the University of Baltimore and a Bachelor of Arts in Accounting from the Catholic University of America.

About Jason Dudas

Partner & CPA

Jason is a Partner in our Vienna, VA office. Since joining the firm in 2009, he has worked closely with clients on tax, audit and accounting issues. Jason has become an expert in construction accounting and is a member of the Real Estate and Construction CPA’s. He also has experience with research and development credits, and tangible property regulations.

About Rosie Cheng

Finance Consultant

Rosie Cheng is a Finance Consultant at Ryan & Wetmore. She focuses on government contracting services and produces many of the firm’s government contracting newsletters. Rosie graduated from Georgetown University with a Master of Science in Management and from William and Mary with a Bachelor of Business Administration.