Inflationary Update - Federal Government Contractor Minimum Wage Increase

Key Details: The U.S. Department of Labor (DOL) announced on September 30, 2022, an increase of the federal contractor minimum wage due to inflation. The notice, titled “Minimum Wage for Federal Contracts Covered by Executive Order 14026, Notice of Rate Change in effect as of January 1, 2023”, (the “Notice”), sets to increase the minimum wage from $15.00 per hour to $16.20 per hour. This 8% increase will take place on January 1, 2023.

Background

President Biden’s Executive Order (EO) 14026 was set to increase minimum wages for employees performing on covered contracts beginning on January 30, 2022, to $15.00 per hour. The goal of this EO was to strengthen both the economy and the efficiency of federal procurement. Following this announcement, the DOL published a final rule in November 2021 to implement an increase of the minimum wage. This final rule provided that beginning January 1, 2023, and annually thereafter, the minimum wage amount will be adjusted for inflation. Furthermore, the provisions under EO 14026 as described in the Notice establish that the applicable minimum wage to be determined by the Secretary will be:

- Not less than the amount in effect on the date of the determination.

- Increased by the annual percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers.

As such, the DOL released the Notice to increase minimum wage.

What Contracts Does EO 14026 Cover?

EO 14026 covers the following:

- Procurement contracts for construction contracts covered by the Davis-Bacon Act (DBA)

- Service contracts covered by the Service Contract Act (SCA)

- Concessions contracts

- Contracts in connection with federal property or land and related to offering services for federal employees, their dependents, or the public

It is important to note that this final rule only applies to these above contracts if the workers under the contract are governed by the Fair Labor Standards Act (FLSA), the Service Contract Act, or the Davis-Bacon Act. Thus, this increased minimum wage does not apply to grants, contracts with Indian Tribes under the Indian Self-Determination and Education Assistance Act, contracts excluded under the Davis-Bacon or Service Contract Act, employees exempt from FLSA minimum wage requirements, or contracts from solicitations issued before January 30, 2022, that are entered into on or between January 30, 2022, and March 30, 2022, and have not yet been renewed to place EO 14026 into effect. Furthermore, EO 14026 does not apply to manufacturing contracts or for furnishing materials, supplies, or equipment, including those subject to the Wash-Healy Public Contracts Act. Additionally, the required minimum cash wage paid to tipped employees who work under covered contracts is set to increase to $13.75 per hour.

Consider Equitable Adjustment

Federal contractors are encouraged to thoroughly review their contracts to determine if there is a possibility of requesting an equitable adjustment for costs due to this new compliance obligation. Price adjustments may be available under existing contracts, and as such, contractors should meet with their lawyers to discuss the relevant change clauses contained in contracts. For further information regarding inflation risk mitigation strategies and Economic Price Adjustment clauses, please see our article here.

Key Planning Items for Contractors

Federal contractors and subcontractors can stay ahead of the upcoming change by:

- Understanding which contracts and employees are covered under the final rule.

- Identifying any contracts, or labor categories related to contracts, where employees are being paid wages below the revised $16.20 minimum.

- Analyzing the financial impact this will have on contracts in terms of increased labor costs for existing and renewing contracts with option year pricing and escalation based on wages below the new $16.20 minimum.

- Incorporating the revised wage standards into contract pricing, bids, and proposals going forward with continued awareness of annual Consumer Price Index (CPI) adjustments to the federal minimum wage.

- Understanding posting and notification requirements. For contracts with employees covered by the Service Contract Act or the Davis-Bacon Act, employers are required to post a notification at the worksite for employees.

- Determine if your contract falls into one of the four categories that EO 14026 covers. If so, if they were entered, extended, or renewed prior to January 30, 2022, they are generally subject to a lower minimum wage rate as established in EO 13658.

Wage and Contract Pricing Updates - Prepare Now

For federal contractors already familiar with wage determination compliance, for example on an SCA-covered contract and labor category, it is important to note that the federal minimum wage requirements in EO 14026 will exist simultaneously with wage determinations such that the contractor will be required to pay the higher of the two to covered employees.

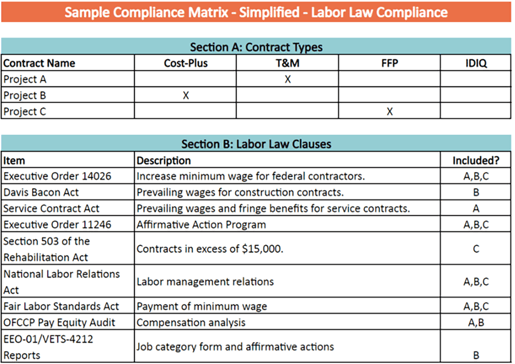

Contractors should aim to create a contract matrix to visualize the various labor law compliance items required under certain contracts. This will enable contractors to keep track of and continuously update compliance items. Ryan & Wetmore have created a sample contract matrix here for reference. Please note this contract matrix is not inclusive of all labor compliance clauses and should be used as a sample. For further information on contract matrices, contact us today.

Conclusion

Contractors are encouraged to thoroughly review the Notice and EO 14026 to understand the specific requirements applicable to both current and future contracts. Contractors are also encouraged to review this page on the DOL website to gain further understanding regarding compliance and posting requirements. For more information on this subject, other topics regarding labor law compliance, or compliance checklists for government contractors, contact Ryan & Wetmore today.

Today’s Thought Leaders

About Peter Ryan

Partner, Co-founder, & CPA

Peter T. Ryan co-founded Ryan & Wetmore in 1988 with business partner Michael J. Wetmore. Peter provides clients with the best strategies for success. His expertise extends across various industries. Peter obtained a Master of Business Administration in Finance from the University of Baltimore and a Bachelor of Arts in Accounting from the Catholic University of America.

About Jason Dudas

Director & CPA

Jason is a Senior Manager in our Vienna, VA office. Since joining the firm in 2009, he has worked closely with clients on tax, audit and accounting issues. Jason has become an expert in construction accounting and is a member of the Real Estate and Construction CPA’s. He also has experience with research and development credits, and tangible property regulations.

About Rosie Cheng

Finance Consultant

Rosie Cheng is a Finance Consultant at Ryan & Wetmore. She focuses on government contracting services and produces many of the firm’s government contracting newsletters. Rosie graduated from Georgetown University with a Master of Science in Management and from William and Mary with a Bachelor of Business Administration.