Pros & Cons of Buying vs. Leasing Construction Equipment

[Updated July 2023]

As we cross over the halfway point of the 2023 year, it is a great time to begin reflecting on the year and plan for what is to come the upcoming seasons. One critical aspect to evaluate is your company’s construction equipment.

Does your company need new equipment? Are there high maintenance costs associated with your company’s equipment? Can your company afford to purchase new equipment in this moment? When is the right time to make a large equipment purchase?

These are all questions and conversations you and your construction company should be having internally to ensure that the next uphill trek does not have to be bogged down by equipment issues.

More often than not, finding where to begin when it comes to acquiring equipment becomes a cumbersome task, and there are many factors that come into play when deciding how your company is going to have equipment available for your pending, ongoing, and future jobs. Additionally, the current climate that is plagued by inflation, high interest rates, and equipment scarcity may impact how difficult it might be to obtain (buying or renting) equipment in the future. Among the top decisions as it relates to equipment is determining whether to buy or lease your equipment. Below are the pros and cons of each:

Buying Construction Equipment

Pros

Depreciation write-off in the year of purchase.

Under the Tax Cuts and Jobs Act, contractors are able to take a deduction for the cost of machinery and equipment purchases made each year. This provision is referred to as bonus depreciation and there is no limitation on the number of purchases.

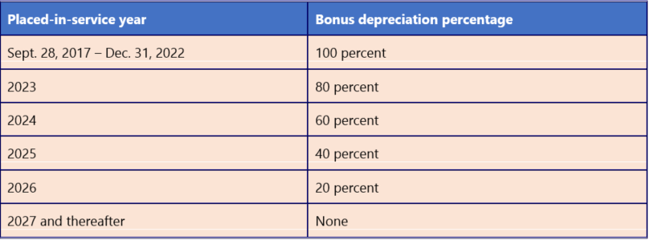

The provision is available for assets acquired and placed-in-service after September 27, 2017. The provision also allows bonus depreciation to be applied to both new and used property. This provision allows contractors immediate cost recovery on equipment purchases in the year of purchase. You should consult with your tax advisor before making large equipment purchases prior to yearend to make sure they fit into your tax planning strategy. For the year ending December 31, 2023, machinery and equipment can be bonus depreciated up to 80% of their 2023 purchase price. The chart below shows the phase-out of bonus depreciation under the provision.

In addition to bonus depreciation, companies can also take advantage of a 179 deduction that allows companies to take a full deduction for the cost of machinery and equipment qualifying purchases made each year. For the year ending December 31, 2023, the 179 deduction limit was raised to $1,160,000 with a total equipment purchase limit of $2,890,000. The previous 179 deduction limit was $1,080,000 with a total equipment purchase limit of $2,700,000. If total equipment purchases exceed $2,890,000 the 179 deduction decreases dollar for dollar, reaching zero once $4,050,000 of equipment is purchased.

You own the equipment.

After following through with purchasing your own construction equipment, you never have to worry about availability ever again. Since it is now your construction company’s property, it will always be readily available for your use. However, needless to say, utilization is critical here and purchasing such an investment only makes sense if demand and utilization will be high.

Serve as collateral against future loans.

Now that you are the rightful owner of your own construction equipment, you can leverage the equipment towards future loans that require proof of assets. Your inventory of construction equipment will greatly appeal to banks and investors when they are deliberating whether your company is an appropriate fit for the loan being requested.

Can sell equipment to recoup some of the costs.

If you come to find that your purchased equipment is no longer satisfying your current needs, you have the opportunity to put your company’s equipment on the market to earn back some or all of your capital investment. The salvage value of the equipment should be considered at the time of purchase.

More options for financing. Not stuck to lessor terms.

As you are deciding between renting and purchasing equipment for your construction company, take into consideration the diversity of the various rates you will receive from different banks as you seek a financial loan. Typically, with a rental lease, you are confined by the parameters of the terms, which includes pricing. In contrast, when purchasing equipment, you are given more bandwidth when it comes to matters such as the number of years you are allotted to repay said loan.

Cons

Cash is tied up.

At any and every point in time, cash is king, but this is especially true during a pandemic. Given the nature of a global health crisis, there is no normalcy, and almost everything functions under ambiguous terms. This week, operations may function in a manageable fashion, but next week may not be the same story and suddenly your company has a pressing need for available cash. Unfortunately, cash flow is tightly wrapped in and around your large equipment investment like the wrapping paper of an expensive holiday gift, leaving your business struggling.

Recurring high maintenance & software costs.

Owning any type of property is like agreeing to be the caretaker and provider of said property till death do you part. Like a child, you have to make sure it is fed, and its needs are met. When owning construction equipment, there are certain costs associated with proprietorship, such as regular maintenance and software costs.

Repairs and general maintenance of your machinery and equipment allow your assets to function in tiptop shape, and if it was not already obvious, good maintenance is good for business. Unfortunately, the cost of maintenance and software updates are not included in the overall price of the equipment, so be sure to account for the periodic fees of repairs when making this significant investment with equipment. Note that purchasing equipment that includes scheduled maintenance software will allow you to be alerted when routine maintenance is required, giving you insight into the health of your equipment before any major damage is done.

Storage and transportation.

As an equipment owner, your company can no longer rely on transportation being managed by a third-party vendor. Nor can your company rely on simply going home after a long project day and leaving behind the equipment for a transportation company to pick up and return to a secure storage location. This burden will now be on the shoulders of your company, and this burden will come in the form of a monetary cost. Finding a storage unit/location will have an associated fee and purchasing/leasing transportation will also have a pretty price tag.

Leasing Construction Equipment

Pros

Save your cash today and reserve capital.

You know the saying, “Save it for a rainy day,”? Well, that is exactly the thinking here when it comes to the first pro of leasing construction equipment. With rented property, nothing is ever permanent and there is no cash being tightly gripped by the equipment. This allows you to save your cash for a rainy day or a day when cash is unexpectedly required. Furthermore, having available and accessible cash allows you and your company to be in a position of security, giving you flexibility with where your cash can go.

Save on maintenance costs (typically the responsibility of the lessor).

Springboarding off the previous point, choosing to lease equipment means that your company will 1) have capital available in the form of cash, and 2) not have to see cash go to waste so to speak on expenses such as maintenance costs. Your pockets will thank you for opting to make a large investment on equipment.

Not stuck with obsolete equipment.

It is no secret that things in life depreciate over time, excluding fine wines and liquors that is. In the construction arena, equipment may become obsolete as new technologies are invented and implemented. But as a renter, this will never be your concern. Instead, your team will benefit from all the new advancements and technologies as they become available to the field.

Cons

May pay higher overall costs over the life of the lease.

In today’s world, convenience is something we have become accustomed to paying for whether you agree with the concept or not. As a result, you may find your construction company paying higher overall costs for leasing equipment because you are paying for the convenience of accessing it without having to worry about maintenance, storage, and other costs (including what is added to the cost to ensure a profit is made). Yes, your company will have less stress because of the temporary nature of the lease, but because of that, you may be paying more out of pocket. In addition, with inflation and interest rates on the rise, monthly lease payments could be higher than before and widen the gap between the outright purchase price and sum of all lease payments.

May not always be able to get equipment when needed.

If you are leaning towards being a leaser because you find that this option is more suitable for your company and its needs, please do consider that you may run into some issues regarding availability. Many companies, similar to yours, would also prefer taking the route as an ongoing renter, but because of this, demand for equipment is increasingly high. It may very well occur that a piece of equipment that you need on a given day is unavailable, but this is the reality of being a renter.

Tax write-off over time as lease payments made.

Should you decide to lease equipment as opposed to purchasing it, your company can only take a portion of the expense each year over the term of the lease. To provide more context, if your company were to buy equipment, your company would be able to collect the entire expense of the equipment immediately through the 179/bonus depreciation expense.

Here is an example to illustrate the point we are trying to make:

Suppose your company was to buy a forklift priced at $50K today, your company would receive a $50K expense that same year. In contrast, if your company were to lease a $50K forklift over a course of five years, your company would receive a $10K expense per year over the span of five years.

No equity in the equipment to sell in the future.

As a leaser who possibly has more temporary needs, you forgo the opportunity of creating equity from ownership of the large investment that is equipment. With all major decisions in life and even across the workforce, being clear of your goals and objectives can make decisions like this easier. If you plan on being in the construction space for years on end, develop a long-term game plan that includes matters such as equity. Furthermore, ensure that you are not reporting your equipment twice as a personal property sales tax should you decide to invest in construction equipment.

Lease terms may be longer than you actually need the equipment.

Another drawback of renting equipment is having to deal with lease terms that don’t exactly meet your needs. You may only need a certain piece of machinery for a month, but the lease term requires you to rent the equipment for a minimum of three months. In this scenario, it will be crucial for your construction company to conduct preliminary research on different equipment vendors and their offerings. In the same vein, this brings us to the next point.

Hidden terms in the lease that may cost you when returning the equipment.

While we highly recommend that your company takes the necessary steps by informing yourself through exhaustive research on the various vendors and their offerings, we also strongly encourage you to take your time when reading through the lease. Being hasty with your decision just to get your hands on a piece of equipment for your next project can land you in a position where you are paying additional fees because you failed to review the fine print.

Potentially higher interest rate vs. buying equipment outright.

Action Items For Today

- Make certain that your accounting staff has a software tracking system to ensure tax payable amounts are properly recorded in each state and not intentionally taxed in more than one state.

- If your company chooses to lease equipment, leasing invoices need to be revised for duplicate expenses related to sales tax and personal property tax. Who is responsible for these costs?

- Check and verify that your construction equipment has up-to-date software that measures utilization, maintenance, and work order tracking.

- If your company’s profitability is up in 2023, consider purchasing construction equipment now vs waiting till 2024 when bonus depreciation goes down another 20%. Please consult your tax advisor before purchasing construction equipment prior to year-end.

- Review your current equipment utilization. Do you really need new equipment or could you increase the utilization of current equipment? Does our backlog create a need for more equipment in the near future?

All in all, there are many factors to think about when buying or leasing equipment, and one option is not better than the other. In the grand scheme of things, it simply boils down to your current needs while considering the future growth needs of the business. Regardless of if you choose to rent or buy, now is the time to get started if you are in need of equipment.

If you found this article useful or if you have any questions concerning the material discussed above, please do not hesitate to contact Jason Dudas, CPA, Construction Specialist, and Partner at Ryan and Wetmore.

Today’s Thought Leaders

About Jason Dudas

Partner & CPA

Jason is a Partner in our Vienna, VA office. Since joining the firm in 2009, he has worked closely with clients on tax, audit and accounting issues. Jason has become an expert in construction accounting and is a member of the Real Estate and Construction CPA’s. He also has experience with research and development credits, and tangible property regulations.