BDO’s Technology Industry Group 2023 Predictions

Ryan & Wetmore has been a member of the BDO alliance for the last 14 years. The article below is BDO's 2023 predictions for the technology industry. Contact us for further information and expertise.

On the back of a turbulent year, technology companies are facing a slew of new pressures. In 2023, the technology industry must be prepared for a shifting M&A environment with dealmaking likely to play a small role in driving growth. It is highly likely that this year will usher in a wave of tech startups focused on cash flow over a “growth at all costs” mentality. Additionally, wide-spread industry layoffs and an increasing focus on corporate governance will put technology executives – at both the startup level and at established organizations – under the microscope.

These factors and more are setting the stage for a busy year in the technology industry, where new priorities such as data privacy, antitrust compliance, and heightening consumer expectations, will take shape.

Above all else, tech teams will need to build resiliency. The market slowdown should give company executives time to assess internal practices and plan strategically. Ultimately, we expect that despite economic headwinds, the technology industry can and will rise to the challenge.

Introducing the seven trends we expect to shape 2023:

1. M&A deals will be fueled by a record number of take-private actions.

In 2023, we will see M&A activity get a boost from an increase in public companies being taken private. These M&A deals will be fueled by lower valuations across the board.

PE companies have been keen on take-privates throughout most of 2022. We expect that to stay consistent in 2023, as low corporate valuations allow PE firms to entice technology companies away from public markets.

During the first half of 2022, PE firms spent roughly $227 billion globally – a record high – on take-private deals. This was an increase of 39% year-over-year for that time period. As public companies continue to face economic headwinds, including wide-scale layoffs in the tech sector, meeting earnings expectations will likely remain challenging. Corporations that have been limping along in the stock market will be prime targets for interested PE sponsors looking to make a deal.

Additionally, due to these dynamics, we anticipate M&A deals to likely be stock-based instead of cash-based throughout, at least, the earlier part of 2023.

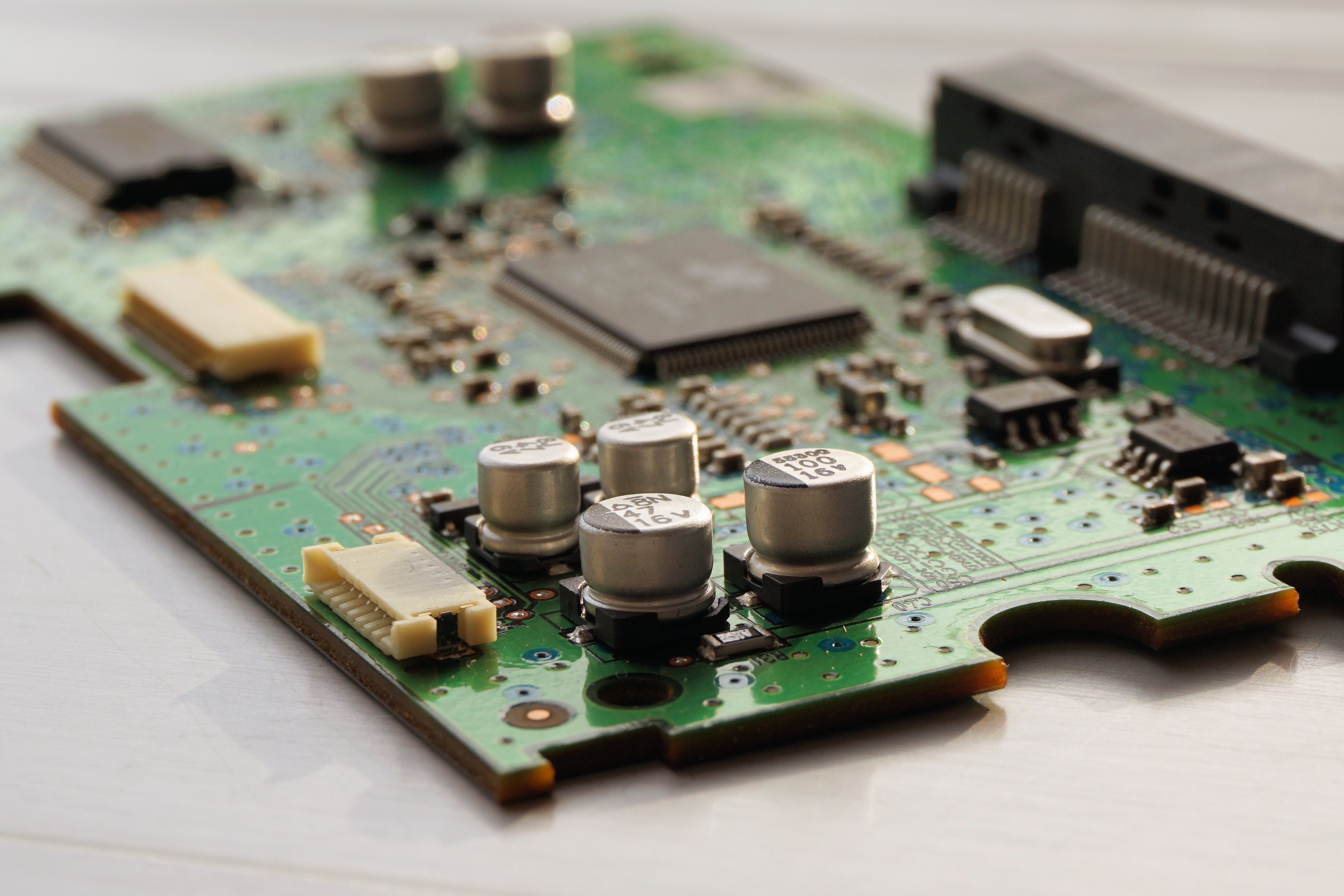

2. The U.S. will see a boom in Semiconductor Onshoring.

The CHIPS for America Act and the funding it provides will act as a much-needed incentive for chip producers to bring their manufacturing back to the U.S. If the CHIPS Act is successful, then we may also see additional funding initiatives from the federal government, in years to come, that further support domestic chipmaking.

While the chip shortage will not be entirely alleviated in 2023, we will see some of the pressure taken off as manufacturers make strides. Companies will be focused on building new semiconductor fabrication sites domestically and/or moving chip plants out of China into new locations, such as South Korea. Micron announced a plan to invest $100 billion to build fabs in upstate New York, while Intel has already committed to a $20 billion fab-production plan in Ohio. Bringing manufacturing operations closer to home will have positive effects on supply chains, as technology companies get better access to necessary materials that boost process efficiencies.

At the same time, the U.S. will continue to wield export control.

In October of 2022, President Biden announced aggressive action to slow down China’s advanced semiconductor manufacturing, barring U.S. companies from supplying the necessary technology China needs to produce advanced logic and memory chips. Intentionally limiting China’s access to these exports dampens China’s ability to maintain superiority in semiconductor chip manufacturing and waters down their power to produce super computers and artificial intelligence. Also likely, however, is that we will see companies finding workarounds. For example, chipmaker Nvidia already announced a substitute product– a slower chip – it plans to offer customers in China.

3. The next great entrepreneur might have just been laid off.

The technology industry saw massive layoffs in 2022. But during times of strife, the industry often sees its brightest minds rise up to disrupt the status quo. We believe we’re bound to see new, innovative entrepreneurs emerge in 2023 who will later become the business leaders of household names or brands.

Take, for example, the story of Airbnb co-founders Brian Chesky and Joe Gebbia. The pair started Airbnb at the height of the global financial crisis of 2008 as they struggled to pay rent in their San Francisco apartment. To “make a few bucks,” they came up with the idea of renting out their space, equipped with a small air mattress, to strangers. Fast-forward to 2022, and Airbnb has a market cap value of over $70 billion.

While the best and most successful startups don’t always take root during a recession, the technology industry has certainly seen some examples that give the belief credence. If we look at data, it’s easy to see that there are far more companies that start in times of economic stability than not. From 2001 onward, there were 95 U.S.-based companies valued at more than $1 billion (aka unicorns) that were founded in a recession as opposed to 757 that were not, according to PitchBook data.

So, while it is safe to say that recessions don’t automatically give way to tomorrow’s most successful entrepreneurs, it is also fair to say that hard times often do push us out of our comfort zones and toward innovative thinking, much like Chesky and Gebbia. One company is, in fact, banking on this: Day One Ventures is looking to invest in new startups that have “at least on founder who has been recently laid off from a tech company.”

With the level of tech-industry layoffs we’ve seen, we think there’s a strong possibility that there is a founder out there who will soon be responsible for the next great disruption.

4. Time to change the channel? Growing number of streaming services raises eyebrows.

The media industry has come full circle. In 2023, we will see an increasing number of streaming service providers consolidate and/or be acquired to package offerings. This is not dissimilar from what cable providers used to do, providing channel packages to consumers.

In a somewhat ironic evolution, streaming services are mirroring cable’s old route. When streaming services first launched – namely Netflix and Hulu – the main idea was to lure consumers away from pricey cable packages with low monthly fees and zero (or limited) commercials. And it worked.

As more consumers canceled their cable packages, however, major networks started launching their own streaming subscriptions – think Paramount, HBO Max, or AMC+. Today, virtually every cable channel or network has its own streaming and/or subscription option, with 200+ streaming services currently available. For consumers, it’s too much – 69% of customers somewhat or strongly agree that there are too many streaming or platform services available.

We are, more or less, back where we started, which will inevitably bring consolidation. 2023 is poised to be a year of landmark battles in the industry’s streaming war. Likely on the horizon, Disney+ consolidating with Hulu could result in 198 million combined subscribers– an illustrative example of what streaming providers stand to gain by working together rather than competing for market share.

As more deals like this are announced – and there are several in the works – more streaming companies will be looking toward consolidation in hopes it will help them capture wallet share in an increasingly competitive sector.

5. The “Grow-At-All-Costs Mentality” is on hiatus.

The growth-above-all-else startup mentality is losing ground. This year, we will see late-stage tech startups keenly focused on improving their cash flows and prioritizing it to build resilience.

Cash flow will be a primary metric that late-stage startups will be measured by, instead of just growth, which has been prioritized for years at all stages of the startup lifecycle. But as many tech companies try to garner investor attention and/or receive valuations at higher multiples, they’ll need to keep their eyes on how much cash they’re burning.

In 2023, startups looking to IPO or assessing other exit strategies will need to paint a sustainable and healthy financial picture, particularly after the drop-off in investor appetite we saw in 2022. There was $7.7 billion in fundraising and only 70 IPOs, as of November 29, 2022.

While founders should always try to split their focus between growth and achieving positive net cashflow, it has traditionally been a hard balancing act, with month-to-month revenue growth often taking priority. However, to succeed amid current economic headwinds and to secure additional funding, go public, or be an attractive acquisition target, a shift will be necessary, at least for the next 12 months. In Q3 2022, venture funding totaled $81 billion, down 53% year-over-year, according to CrunchBase News. We’ll start to see more tech companies prioritize cash flow metrics, efficiencies, resiliency and extending their runaway above a “growth first mandate.”

6. Regulatory Mashup: Data privacy and antitrust rules will intertwine.

The data privacy issues of the technology industry, especially Big Tech, are increasingly being viewed through an antirust lens. Technology company mergers will be scrutinized not only for traditional competition law compliance, but also for how much consumer data those mergers will or would combine.

The FTC in particular has hinted at new regulations to come that address this intersection. President Biden has also signed an executive order that underlines the link between the two, urging the FTC to release more rules around the “ties between tech companies’ power and the personal information they collect.”

The five companies that are traditionally regarded as the Big Tech giants collect a combined 261 data points per user. And that’s just Big Tech – this doesn’t take into account the massive amount of data points collected on consumers across virtually every app or platform they use. As the number of data points each consumer generates increases with each app download or click, the more information technology companies have access to. We can start to see how tech M&A has the capacity to yield anti-competitive behavior depending on the size and scope of the deal.

In 2023, we will most certainly see increasing discussion and proposed regulations around this issue. Technology companies both big and small should consider how merged data may look to antitrust regulators – start thinking about this during the due diligence phase of M&A. The ways in which technology companies protect and leverage their customers’ data will be under the microscope, especially as tech organizations search for new ways to monetize data – another trend we believe the industry will see more of during 2023.

Tech companies will assess the ways they can compliantly use data for profit, such as leveraging data for marketing strategies or selling it to create additional revenue streams.

7. Corporate governance is in the hot seat.

This year, technology company executives will face greater pressure to prioritize corporate governance, the ‘G’ in Environmental, Social, and Governance (ESG) practices. Amid stakeholder and customer calls for technology companies to show progress on their ESG commitments, leaders will be compelled to develop more structured and transparent governance frameworks to mitigate reputational risk.

Stakeholders will increasingly focus on corporate governance protocols and practices, which may include how an executive’s actions impact board relations, workforce engagement, executive compensation structures, and reputational crisis management. While measuring and improving environmental externalities will remain paramount, we expect 2023 will see the ‘G’ earn a comparable level of attention. Policies to consider: Codes of Ethics, HR Staffing and Monitoring Processes, and Disclosure and Mitigation of Potential Conflicts of Interest.

Investors in technology are watching ESG practices closely – roughly $30 trillion in professionally managed assets are already subject to ESG criteria, according to Harvard Business Review. Beyond this, 94% of private equity fund managers expressed that their limited partners want them to incorporate ESG criteria into their investment strategies, according to BDO’s Spring 2022 Private Capital Pulse Survey.

We expect at least one technology company will wander into corporate governance misconduct and face serious repercussions for those ESG violations due to the mounting scrutiny tech executives are being placed under.

Key Details: The Small Business Administration (SBA) issued a final rule on November 29, 2022, to implement a statutory requirement to certify Veteran Owned Small Businesses (VOSB) and Service-Disabled Veteran-Owned Small Businesses (SDVOSB) who participate in the Veteran Small Business Certification Program. This final rule was effective on January 1, 2023. Thus, businesses seeking government contracts that are set aside or sole-source for VOSBs and SDVOSBs are encouraged to thoroughly review this final rule as the certification process will be transferred from the Department of Veterans Affairs (VA) to the SBA. For mor

Written by Hank Galligan, Matthew Dyment and Stephanie Hewlett. Copyright © 2023 BDO USA, LLP. All rights reserved. www.bdo.com